This site uses cookies to provide essential functions, improve your experience, collect anonymous generic usage data, and to provide a personalised experience.

Why Buy A New Home

Why should you consider buying a new home?

Joe Tustin, New Homes Sales Director

Sales across our New Homes and Resale offices have grown year-on-year, with more than 400 new buyer registrations each month despite challenging market conditions. This success stems from our strategic client advice and traditional agency values of picking up the phone, building relationships, and truly understanding our buyers. Combined with tailored digital marketing, this proactive and personal approach has generated more viewings than online portals.

The property market has remained challenging in Q3, with buyer demand still subdued. However, there have been some encouraging signs. While the base rate has held steady at 4%, recent reductions in mortgage rates have helped restore much-needed confidence, particularly in the sub-£500,000 bracket, where we’ve seen a notable rise in enquiries and buyer activity.

At the higher end of the market, particularly for properties priced above £1,000,000, conditions remain more difficult. Buyers in this segment continue to be cautious, often unwilling to compromise and taking longer to commit to a purchase.

A key factor behind this hesitancy is the uncertainty surrounding the upcoming November Budget, which is casting a shadow over the prime market. There is ongoing speculation about potential changes to property-related taxation, including:

As a result, a growing number of buyers are delaying decisions until after the Budget announcement. Consequently, the market is increasingly driven by needs-based buyers, moving for work, school catchments, family changes, downsizing, or, more commonly this year, affordability reasons.

As we’ve seen in recent months, the market can shift quickly and often without warning. We’ll continue to monitor developments closely to ensure we remain agile and ready to guide our clients through whatever the next quarter brings.

If you’re reviewing your current sales and marketing strategy or would like an appraisal on a scheme, I would be delighted to assist and share advice on how to best position your development for success as we move into the new year.

---

Nina Langford, Land Director

After a lively few years, the land market has settled into a steadier rhythm. Developers, investors, and landowners have been getting used to a new normal — one where borrowing money is still expensive, building projects are harder to deliver, and planning approvals are taking longer than ever.

It’s a challenging environment that requires patience and careful management and the increased pressure that everyone is under is evident. The Government has made it clear that it is determined to help address the housing crisis, and the landmark Planning and Infrastructure Bill is progressing rapidly through Parliament.

While we’re avoiding detailed Budget commentary until after delivery, it’s clear the recent announcements, particularly at the prime end of the market, where talk of mansion taxes, Capital Gains, and Stamp Duty reforms has fuelled hesitation among buyers and investors. Developers are actively reassessing their investment and delivery strategies to safeguard capital and optimise deployment, with the market continuing to evolve amid a balance of caution and emerging optimism.

With recent NPPF changes and the Government’s drive to “get Britain building again,” subject to planning deals are experiencing a surge in activity. Sites that might have been overlooked even a year ago are now being brought forward, and more landowners are seeking professional advice than ever before.

It’s an ideal time for landowners to review their options, particularly where grey belt opportunities exist or where a lack of five-year housing supply creates a favourable planning context.

Nevertheless, achieving planning consent remains far from straightforward. Local planning authorities continue to face staffing shortages and procedural challenges, so success relies on realistic timeframes and well-prepared, design-led schemes capable of withstanding detailed scrutiny.

The Home Builders Federation has urged the Government to ensure that local authorities are properly staffed and resourced by increasing the number of qualified planners. It also recommends introducing common adoptable infrastructure standards, mandatory adoption within reasonable timeframes, and a standardised Section 106 template to bring greater consistency and efficiency to the planning process.

As well as landowner led development sites, we are seeing a number of experienced developers, having secured strong planning consents — in some cases across multiple sites simultaneously — now taking a more strategic view of their pipelines.

With capital still tied up in the market and a slowdown in sales activity, many are reviewing their portfolios of strategic and consented sites, choosing not to build everything out immediately.

These consented sites are proving highly attractive to other developers who have gaps in their build programmes. After a period of intense competition for land, such opportunities provide a quicker and more certain route to delivery, particularly where detailed consent has been granted and construction can start without delay. This is especially true for smaller schemes below the affordable housing threshold, where no affordable provision is required.

This area has been one of the biggest challenges of the year, particularly in recent months.

Many housing associations are under pressure from higher interest rates, increased cost burdens (including building safety, net zero, and remediation requirements), and a reduced capacity to take on new affordable homes.

As a result, several registered providers are prioritising safety, remediation, and maintaining existing stock over expanding their development programmes.

According to the Home Builders Federation (HBF), more than 17,000 affordable homes with detailed planning permission are currently stalled, as registered providers are not bidding to purchase them under Section 106 agreements. A further 8,500 units may be at risk over the next 12 months for the same reason. This could delay over 700 housing developments nationwide — a clear sign of a “perfect storm” of economic, delivery, and policy challenges within the affordable housing sector.

As agents, we are having to navigate these issues carefully, structuring deals that safeguard both landowner and developer interests to ensure transactions can continue. The situation is significantly impacting current land values.

We have been busier than ever in 2025, with strong levels of transactional activity maintained throughout the year. It remains a market where our early involvement can add real value, helping to shape strategy, unlock opportunities, and ensure delivery.

Please don’t hesitate to get in touch if you would like to discuss any land or property-related matter.

---

Alex Thomson, Head of Digital

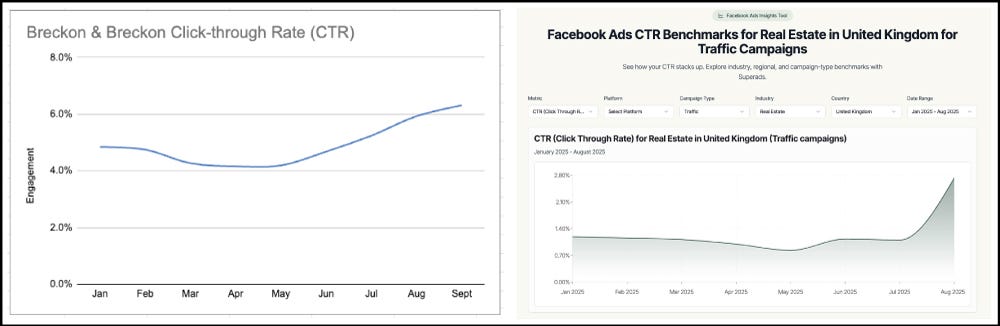

The two screenshots below show the (real estate) industry median for Click-through Rate for ads run on Facebook, Instagram and Messenger vs. what Breckon & Breckon do. Click-Through Rate (CTR) is the percentage of times an ad that was seen resulted in a click.

The UK average for 2025 is 1.3%, whereas Breckon’s is currently 4.93%! This not only means we stretch budgets further enabling us to run more campaigns, ads, and show homes to more people, but are able to deliver better leads to our clients at a fraction of the cost (industry average = $1.48 vs. Breckon average = $0.12). We have witnessed first-hand how much other agents spend to achieve a tiny portion of the quality of online traffic we are able to deliver.

A huge portion of searches for ‘new homes’ begin with a simple Google search, with some estimates having it as high as 30-35%. This year we looked at aggressively targeting phrases such as ‘new homes’, ‘new developments’ and ‘new builds’ on Google.

Breckon & Breckon now consistently sits at the top (spot) of Google for several high volume keywords including ‘new homes in oxfordshire’. The New Homes page has appeared 327,000 times in the last three months (130% up), and often ABOVE Rightmove.

SEO is one of our best long-term marketing strategies as it delivers high-quality traffic with over 60% of our website conversions come from Google.

---

Marcus Gunn, Director of Financial Services (carbonoxford.com)

New build lending has tightened a little as we move to Autumn with unit pricing being pivotal to buyer appetite. Mortgage funding remains competitive although valuers remain extremely cautious and sensitive to any inflated unit price. As ever collaboration between all professional parties is key to ensure a smooth transaction.

One market comment is the cost of materials and labour for refurbishment has highlighted the attraction of ‘ready to move in’ new build compared to the familiar, ‘house needs work’ 2nd hand market. Many clients find it can be more palatable to raise money on a straight mortgage than save the physical cash needed plus mortgage to fund a refurbishment.